Backstory in Indonesia & profitability

#2 - Why did we started in Indonesia; making our organizational change happens; deep dive on the way we measure the EBIT and related metrics

Hi,

Welcome to issue #2 of Odoo Trailblazer, our journey to become the #1 Odoo partner.

After the first week, I’m thrilled that many people subscribed and read this newsletter :-)

I’m also happy to introduce a new “light” section in this newsletter; the “backstories”. And this week, it is about Indonesia, especially why we started Port Cities in Central Java.

The main management topic of this week is profitability $$$ and how to set the right targets.

This is complex, and we got many things right and a few things wrong.

Agenda

Some backstories: Tegal, Indonesia

Making change happens and setting the targets for 2023

Profitability: set high targets and measure the right data

What we got wrong in the past and our plan for 2023

Measuring profits: the common traps

How do we set profit targets?

What KPIs do we use to control margins?

Success celebration & reward, and some Odoo tips

Next steps

1. Some backstories: Tegal, Indonesia

In 2015, I established Port Cities Indonesia as a business venture, leveraging my roots from Belgium. We later founded Port Cities International in Hong Kong to expand our business operations overseas.

So why did we start an Odoo partnership in Semarang, Indonesia?

In January 2012, I went to Indonesia to work for Ethnicraft, a Belgium-based furniture company. I was primarily tasked with managing the supply chain for their Tegal factory, which employed over 1100 individuals.

Tegal main avenue: we often used “Bejak” to travel from the train station to our house. At the time, the main train line crossing Java had only track, so when a train was late, we were often stuck for 30-40 minutes in a station to wait for another train to cross.

I was working on logistics and production planning and tried first to improve the Excel files they were using. But soon after, we decided to look for real business software.

Considering costs and flexibilities, I looked at the open-source solutions and shortlisted OpenBravo and Odoo (then called OpenERP). We started to implement Odoo in their factory, some of their online and physical stores, and their international logistics.

Inspired by Ethnicraft entrepreneurial success story (read more here), and its founders, I decided to become an entrepreneur.

I was only 26 at the time, so I chose something “easy” (spoiler: it is not easy):

A service business, as there is no market or product to create.

An area I already have some skills: Odoo.

Where I knew the market and got some leads: Central Java in Indonesia.

So in February 2015, I took all my savings and launched “Port Cities Indonesia” in the capital of Central Java (the big city next to Tegal).

What was our team like on day 1?

Two former colleagues who are both engineers: Nizar and Rizal.

I found Veri, a French engineering graduate, by giving flyers and interviewed him at a Starbucks.

Charles was our first business profile; later he became a co-founder.

Siti was a freelancer coaching our engineers; she is now a senior director and partner.

We are all still working at Port Cities today.

2. Making change happens, and setting the targets for 2023.

In the last week's issue (you can read it here), we introduced our new organizational approach of consolidating several businesses into larger entities that we refer to as "regions".

To make the change happen, we help each region’s leadership team to:

Assign responsibilities using a simplified version of the RACI model where we assign a person to each responsibility (see Wikipedia). In practice, we list all management tasks and assign them to one of the region’s leaders or any other employee. People don’t need to be “a manager” to take responsibility.

Take ownership of the region instead of their local team. This is a difficult change of mindset, so we accompany them to move step by step.

Set KPIs and targets for the region, but not per country. If you ask a leader to make decisions considering the entire region, but you still evaluate them on their country's performance, they are not going to change. So we set all KPIs for the region.

Today, we’ll speak about how we set the most important target or KPI for a service business: profitability, or more specifically, the EBIT

EBIT = Earnings (profitability) before interests and taxes. The taxes we exclude from the EBIT are only the corporate income, so the taxes on the profit, but not the VAT (value-added tax) or taxes on salaries (personal income tax) for example.

3. Profitability: set high targets and measure the right data

3a. What we got wrong in the past and our plan for 2023

In the last few years, we emphasized too much growth, set narrow margin targets, and weren’t strict enough in controlling it. We thought that if we grow by 50%+, it was OKAY to aim for a 10% EBIT margin.

We were wrong because when you aim for a 10% margin, your actual net profit is between 0 and 5%. Consequently, if an unexpected crisis arises, the company may not have enough financial reserves to weather the storm.

When the recession hit in Q2 and Q3 of 2022, our monthly revenue decreased by ~$200k, and despite a quick response plan, we lost more than $50k per month for more than six months.

We got many of the foundation rights: proper accounting and metrics, such as project gross margin and “invoiceability” (billable rate), were in place. But our main mistake was aiming for a low margin.

Starting in 2023, our main change is to set higher EBIT and “invoiceability” (billable rate) targets. This will need to come together with other improvements:

Hire more carefully

Improve our staff planning and allocation so that we could manage more projects with the same amount of consultants.

Keep investing in quality and consultants training, as it impacts project gross margin and customer satisfaction (and upsell)

Let’s review, in detail, how we actually measure the profits and KPIs.

3b. Measuring profits: the common traps

It seems obvious if you studied business or accounting (profit = sales - costs), but it is not.

Let’s review the four typical mistakes many services businesses make when measuring profit:

Provision for bad payments

Founder or owner salary

“deferred income” and “revenue recognized before sales.”

Provision for accrued expenses

1) Provision for bad payments

Here is what may happen when something goes wrong in an IT implementation project:

Bob, your client and business owner, made a mistake that compromised the project's success. Like many entrepreneurs, he has a high ego and will refuse to pay for his own mistakes.

Your project manager poorly managed the project and hid the issues.

The client’s IT manager screws up, lies to his boss, and tries to build evidence against your business.

You, also an entrepreneur with a high ego, don’t realize your own mistakes and that you should write off your invoices.

Similar cases happen in all industries. Your clients are always very nice until something goes wrong. It may be your mistake or theirs, but either way, they will often try not to pay you.

Learning: if your invoice is not paid on time, or at risk, book a provision for losses now.

The cost is often underestimated, as it includes not just the potential loss of money but also the time and mental strain expended

If you are a young entrepreneur, you are underestimating this risk.

Life is hard; get used to it

At Port Cities, we implemented this in our monthly closing since the end of 2021.

2) Founder salary

Summary: most small company founders and owners pay themselves a salary below market wage, either because their business cannot afford it, or to optimize taxes. It leads them to overestimate their profitability.

Example: a founder claims they make a USD 90k profit but are paying themselves a $40k super gross yearly salary while they are worth $140k. The real profit is not $90k but 90k-(140k-40k).

It becomes visible once you grow and hire outside directors because they won’t accept a salary below market wage.

At Port Cities, we implemented this gradually between 2018-2020.

3) “Deferred income” and “revenue recognized before sales.”

Summary: if you account for your revenue when you invoice or collect the cash, you won’t know your real profit. We use “deferred income” to book the revenue when you deliver it (or when you incur the costs).

Let's say you sign a $120k project to deliver in 6 months to client “GreatCustomer”. You receive a 50% down payment of $60k in November. It is your only client, and you’ve monthly expenses of $21k.

If you don’t use deferred income, your monthly profit will look like this:

According to this approach, in Q4-2022 (October to December), it looks like you’re profitable; in Q1-2023 (January to March), you are losing money, and in Q2-2023, you’re profitable again.

To solve this issue, you’ll book the down payment of $60k in a liability account called “deferred revenue”, and move each month $20k to Revenue. A similar logic can be used to book the revenue in advance in February and March.

When you use the “deferred method”, it is evident that you are losing money each month. Of course, it is easy to see it anyway with only one client, but if you overlap hundreds of clients with varying monthly revenues, it may be very hard to know your actual profit.

In Port Cities, we realize the revenue based on the time spent (timesheets) each month on the project, regardless of the type of contract or invoicing method.

4) Provision for accrued expenses

Similar to the logic of “deferred income”, many expenses will be paid later but are contributing to the current month of operations:

Salary bonus and 13th month.

Taxes other than corporate income taxes.

Other expenses that are not paid monthly, such as licenses or rent.

If you don’t book provisions, you underestimate costs and overestimate profits.

At Port Cities, we implemented it partially since day one. Our HR team plans to centralize payroll and bonus administration for improved efficiency, starting in 2023.

3c. How do we set a profit target?

We set quarterly targets in EBIT margin, i.e. EBIT / Revenue. We expect each of our five regions to forecast a 25% EBIT margin, although 15% is a good benchmark.

Still, we ask for 25% because directors tend to be a bit over-optimistic and plan for the good times.

By forecasting 25%, we expect they will make a median EBIT of 20%

But knowing that the bad times are much worse than the great times, the actual average will be lower than the median.

How do we know if 15% is a good number? According to Yahoo Finance, it seems right as it is the average EBIT margin of Accenture.

3d. What KPIs do we use to control margins?

Most KPIs impact profitability, but let’s look at two critical service business metrics.

Projet gross margin

Billable rate (we call it “invoiceability rate” internally)

1) Project gross margin

This one is not simple to measure. But measuring the gross margin of the product or service you sell is always one of the most important metrics (more important than the profit for some businesses).

The target we set for our team depends on the country, but it is usually around 55%. Of course, it depends a bit on the way of measuring it. Get in mind that a 55% gross margin is not high in a business where you get a long sales cycle done by senior consultants (with high salaries) and where your revenue (and profits) are not stable, while most of your costs are (wages and rent).

2) Staff “invoiceability” ratio (billable rate), i.e. how many % of the hours worked by an employee can be invoiced to clients.

It is the second most important metric in a service business, but still, many service firms don’t require their team to track their timesheets or don’t track this KPI carefully for each employee.

We were used to setting this target between 65% and 80%, but we are increasing it in 2023 to be 80% average for the consulting team.

3e. Success celebration and some Odoo tips

For this newsletter, I decided to analyze who in our team did the best invoiceability ratio (billable rate) for the last six months, from 2022-Aug-1 to 2023-Jan-31.

Kudos to Muhammad Fariz Zulmi for achieving an impressive 987 "invoiceable" hours in just six months! Your consistent ability to secure projects, manage multiple tasks, and accurately track your time is commendable.

Odoo learnings: search for business insights in seconds using search and group by

How did I get this insight? By searching in Odoo in ~30 seconds

Step 1: go to “Timesheets app” to show the timesheets of all employees. Use the list view

Step2: Then add “Filters” (1) “invoiceable is true”, (2) date between Aug-1 and Jan-31, and “Group by” Employee (it sums the entries), and then sort from highest to lowest to see the “winner”.

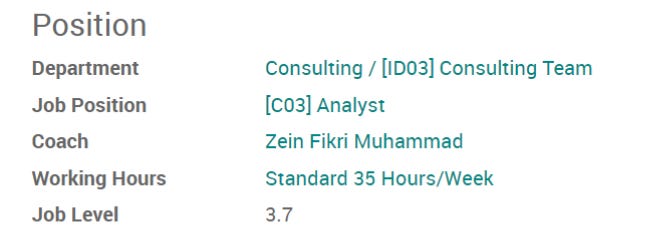

It’s a happy surprise. I don’t actually know Fariz, so I quickly search for more information on him in our Odoo (business software)

Step 1: go to the menu Employee, search his name and analyze the data.

He has worked in our Center of Excellence in Indonesia since December 2021 as an Analyst level 3. It’s a relatively junior position in our functional department, so his invoiceability target is 70%, while he scored ~100%

4. Next steps

Our top management priorities for the coming weeks are:

P&L forecast for 2023

Responsibilities matrix & communication

“invoiceability” analysis

Sales & marketing plan

And that is issue #2 of the Odoo Trailblazer newsletter. Thank you for reading

Please share your feedback, what you want to hear about next week or any business advice.

Follow us on LinkedIn for more updates: Gaspard, the CEO, or our company page.

To know more about Port Cities, Odoo (business software), and our services (help your business with Odoo): https://portcities.net

What a journey! Entrepreneurship is not easy, but once you have the bug you can't live without it. Thanks for the read, reminds me a bit of cfosecrets.io.

Just a note for people who want to get inspired by the "billable rate" filters - base Odoo does not have a filter for "Invoiceable = TRUE", in default Odoo the workflow is quite different, but ultimately there is also a billing logic and filters available that you can use.